New research released by Expedia Group has revealed how sports tourism is transforming how people are travelling and the sector is creating massive opportunities for the travel industry.

In a blog post titled “how to win big with sports tourism”, Expedia Group’s chief commercial officer Greg Schulze said that sports tourism presents “significant economic opportunity” for travel providers and is creating “high-demand periods” for transportation and lodging companies and “boosts host cities’ economies”.

According to UN Tourism, sports travel now accounts for 10% of global tourism spending, while Skift reported that the sports tourism sector is projected to reach $1.3 trillion by 2032.

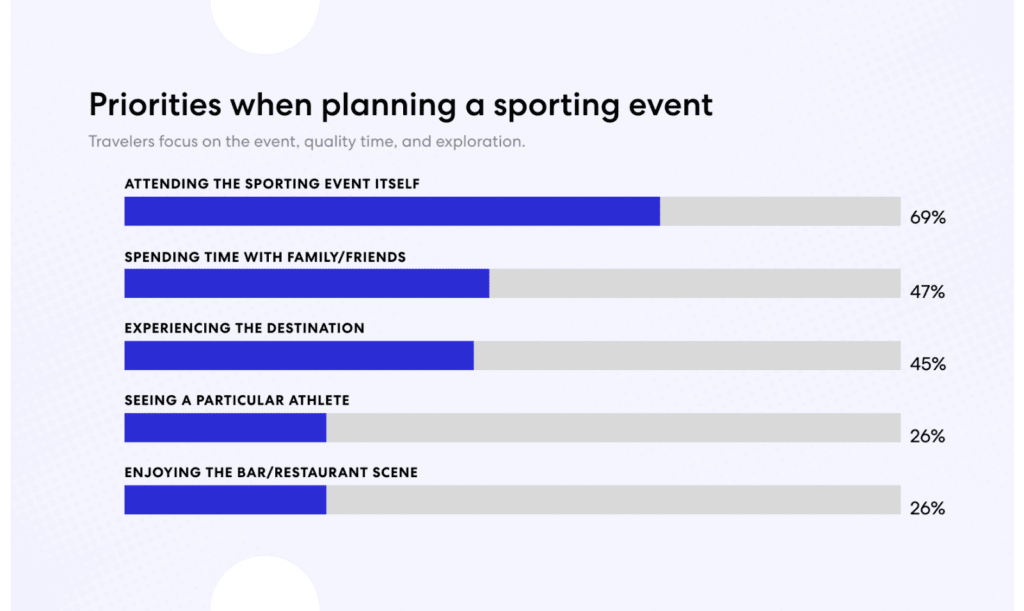

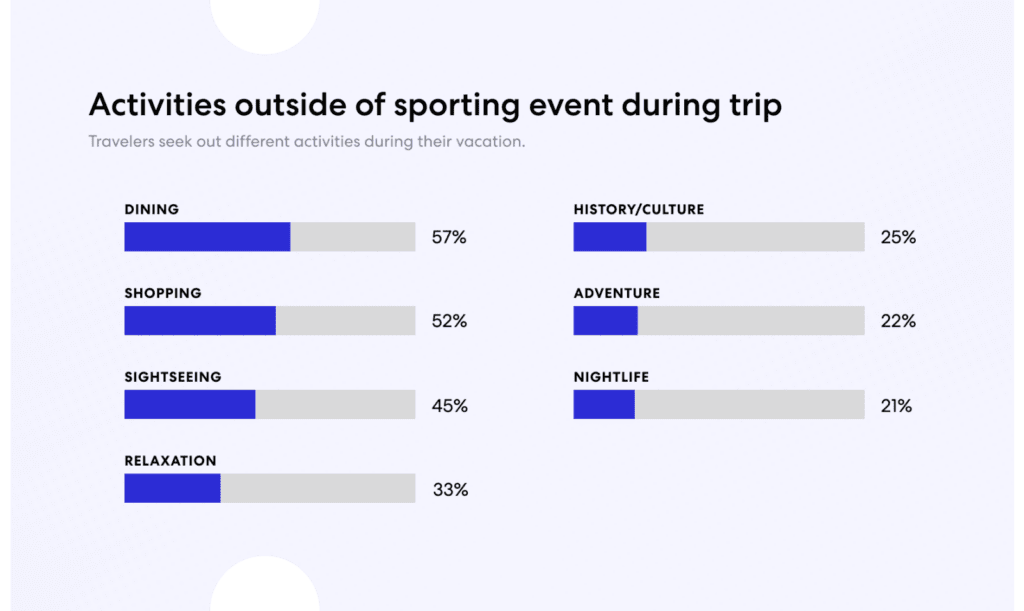

Expedia Group’s data suggests sports trips are about “more than just the event” – they’re a chance for meaningful bonding that is known to positively impact mental health. This could explain why most respondents surveyed attended their last sporting trip with friends (35%), partners (34%), or family (33%).

Findings from the survey serve as a playbook for travel providers looking to capitalise on this high-value market. The research was conducted by Censuswide and included a sample of 2,000 respondents who have travelled for a sporting event in the past 12 months across Australia, Canada, France, Germany, Japan, Mexico, the US and the UK.

Women’s sports climb the table

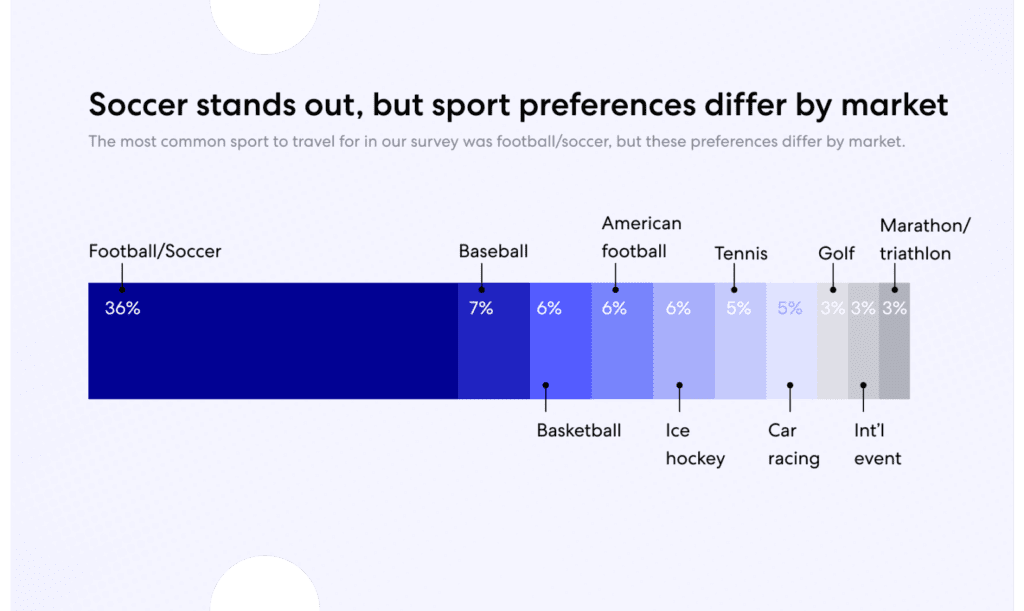

While football/soccer dominates in most countries surveyed, the real growth story is women’s sports. Though 71% of respondents travelled for men’s events, younger generations are breaking this pattern. In fact, 24% of 16–34-year-olds attended mix-gender sporting events (vs. the 20% overall average), while 12% attended women’s sporting events (vs. the 9% overall average).

Whether it’s the Uefa Women’s European Championships, Rugby World Cup, or golf’s Solheim Cup, travel providers have plenty of opportunity to tap into this emerging market through targeted solutions around women’s sporting events.

Fans are willing to go the extra mile

Sports fans aren’t just crossing town, they’re crossing borders. The data shows 44% travelled internationally for their last sporting event, jumping to 56% among travellers aged 16-34. Respondents from several countries were also far more likely to travel internationally, including Canada (62%), Germany (58%), and France (57%). This trend highlights the growing opportunity for travel providers to tap into international markets and reach younger consumers.

And the impact of sports-related travel extends beyond the host city. Three in five travellers with trips longer than a day stayed in a destination outside the event location at some point during their trip. Of these, nearly one in three chose a more well-known spot close by, 20% opted for a destination over an hour away from the sporting event, and another 20% chose a lesser-known nearby destinations.

Travellers also chose to visit cities outside of where they stayed, 81% of those who booked lodging visited other destinations, with 45% exploring nearby areas, 30% traveling within the same country, and 21% heading abroad.

Sports tourism fuels local economies

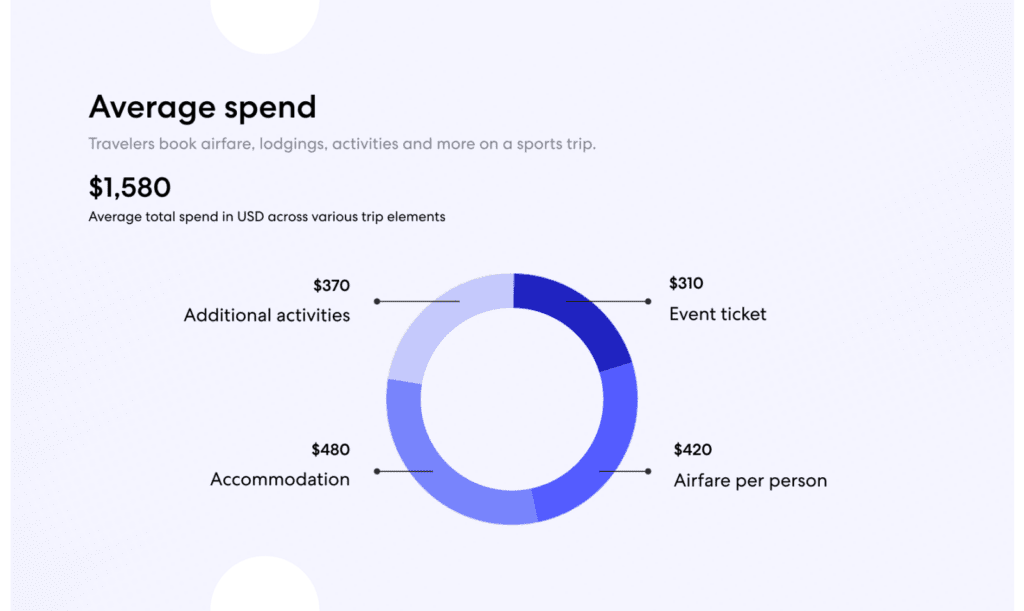

Sports tourists aren’t just filling seats, they’re filling cash registers. When asked about their most recent trip, respondents reported spending an average of more than $1,500 across various trip elements.

On average, attendees spent more than $300 on event tickets for their last sports trip, with airfare costs averaging over $420 per person for those who flew. Lodging also contributes to the economic impact, with travellers who stayed overnight spending an average of $480 on accommodations. Beyond the event itself, travellers typically allocate more than $370 for additional activities such as dining and shopping, further boosting local economies.

Looking ahead, respondents planning to attend sporting events in the next 12 months anticipate spending an average of over $1,200 and have already begun setting aside budgets for their next trip.

The findings illustrate the immediate opportunity for travel brands to engage with this valuable segment of travelers. By leveraging data-driven insights and tailored marketing strategies, partners can effectively meet the needs of sports tourists, driving bookings for hotels, flights and more. This approach not only benefits travel brands but also contributes to the growth of local economies hosting sporting events.

Maximising revenue around compression moments

These cultural events create unique opportunities and challenges. Strategic pricing approaches are essential to avoid pitfalls like low occupancy and high cancellation rates during high-demand periods.

“These findings clearly show that sports tourism has evolved far beyond just attending games, it’s become a catalyst for broader travel experiences and economic impact,” said Schulze. “Fans are creating rich travel itineraries around sporting events, exploring multiple destinations, prioritising experiences with loved ones, and taking time for activities beyond the stadium.

“To help our partners capitalise on this $1.3 trillion opportunity, our study outlines strategic solutions that enable them to optimise pricing, boost visibility during high-demand periods, and effectively target these enthusiastic, big-spending sports tourists. ‘These include leveraging data analytics for dynamic pricing, creating targeted advertising, and developing comprehensive travel offers that cater to the diverse interests of sports fans.”

Read more at expediagroup.com

Key insights from Expedia Group’s study

Main image: pxhere.com. Graphics: Expedia Group